Why Is AAA Lower Than Basis on an S Corp?

Introduction

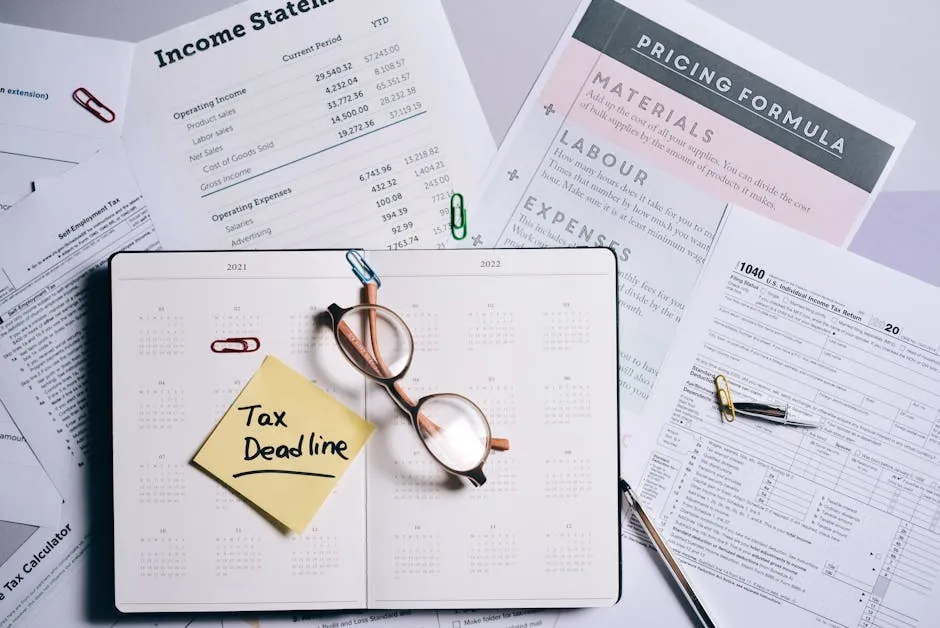

Understanding the Accumulated Adjustments Account (AAA) is vital for S corporations. This account tracks undistributed income that has been taxed to shareholders. Shareholder basis represents each owner’s investment in the company. Discrepancies between AAA and basis can impact tax outcomes. This article explores why AAA might be lower than basis and what it means for S corporation shareholders.

Before diving deeper, it’s worth reading “S Corporations: A Comprehensive Guide to Business Taxation”. This book provides a thorough understanding of S corporations and can be a valuable resource for anyone navigating the complexities of tax regulations.

Summary and Overview

The Accumulated Adjustments Account (AAA) is a corporate-level account that tracks an S corporation’s undistributed taxable income. Shareholder basis, on the other hand, represents the total investment made by a shareholder. Tracking both AAA and basis is crucial for tax purposes.

AAA is adjusted annually based on various factors, including income, deductions, and distributions. This account determines how much can be distributed tax-free to shareholders. When AAA is lower than basis, it can lead to potential tax implications, such as taxable distributions.

If you’re looking for a comprehensive breakdown of S corporations, check out “The Complete Guide to Understanding S Corporations”. It’s like having a tax consultant in book form—without the hourly fees!

Understanding AAA and Shareholder Basis

Definition of AAA and Its Purpose

The Accumulated Adjustments Account (AAA) tracks undistributed income in S corporations. It reflects the income that has already been taxed to shareholders but not yet distributed. This account is crucial for tax calculations, as it determines how much can be distributed to shareholders without incurring additional taxes. When shareholders receive distributions from the AAA, those amounts are generally tax-free. Understanding AAA is essential for navigating tax regulations and maximizing tax benefits for S corporation shareholders.

Definition of Shareholder Basis

Shareholder basis represents each owner’s investment in the S corporation. It includes initial contributions and adjustments for income, losses, and distributions. This basis is significant because it determines the tax treatment of distributions. While AAA focuses on undistributed taxable income, shareholder basis encompasses the total investment, including any loans made to the corporation. The difference between AAA and basis can affect tax outcomes, especially when distributions exceed AAA but remain within the basis.

If you want to dive deeper into tax planning strategies, consider reading “Tax Planning for S Corporations”. It’s an essential read for anyone wanting to maximize their tax efficiency!

Factors Leading to AAA Being Lower Than Basis

Adjustments to AAA

Several items can adjust AAA, increasing or decreasing its balance. Increases to AAA typically come from items of income, such as business profits or capital gains. Conversely, AAA decreases due to losses, deductions, or non-deductible expenses. Distributions also reduce AAA, but they cannot drop it below zero. This interplay between adjustments influences the relationship between AAA and shareholder basis. For instance, if an S corporation incurs significant losses, AAA may decrease, potentially resulting in a situation where its balance is lower than the shareholder basis. Understanding these adjustments is vital for effective tax planning and ensuring compliance with IRS regulations.

Distributions and Their Impact

Distributions play a crucial role in understanding both AAA and shareholder basis. When an S corporation distributes cash or property to its shareholders, it impacts these accounts significantly. Distributions reduce AAA directly, as they represent income that has been taxed but not yet distributed. If distributions exceed the AAA balance, shareholders may still receive funds, but they risk incurring taxes on the excess amount.

Now, what happens when distributions surpass AAA but remain within the basis? In this scenario, the shareholder will not face immediate taxation on the distribution, as it is still considered a return of capital. However, this can only occur if the total amount distributed does not exceed the shareholder’s adjusted basis. If it does, the excess is treated as a capital gain, leading to potential tax implications. This relationship between distributions, AAA, and basis is critical for shareholders to monitor closely.

And speaking of monitoring, don’t forget to keep your financial records organized! A great tool for this is QuickBooks Desktop Pro 2021. It simplifies accounting tasks and can save you from tax-time headaches!

Earnings and Profits (E&P) Considerations

Earnings and profits (E&P) are essential in the context of S corporations, especially regarding the relationship with AAA. E&P tracks a corporation’s ability to distribute profits to shareholders. While AAA focuses solely on taxable income, E&P includes all income, which can create a complex scenario for distributions.

When an S corporation has accumulated E&P from prior C corporation status, it can complicate the analysis of AAA and basis. For instance, distributions made from E&P are treated as dividends, which may be taxable to shareholders. This can lead to different tax consequences compared to distributions made solely from AAA. Therefore, understanding how E&P interacts with AAA is vital for shareholders to navigate their tax liabilities effectively.

Practical Implications for Shareholders

Tax-Free Distributions

AAA plays a significant role in determining the tax-free status of distributions. Generally, distributions up to the AAA balance are tax-free. However, when AAA is lower than the shareholder’s basis, the implications change. In this case, shareholders can still receive distributions without immediate tax consequences, as long as they remain within their basis.

If the distribution exceeds AAA but stays below the shareholder’s total basis, it will reduce the basis instead of incurring taxes. However, once distributions surpass the total basis, any excess is treated as a capital gain, leading to potential tax liabilities. Understanding this relationship is crucial for shareholders looking to optimize their tax positions and ensure compliance with tax regulations.

Loss Limitations and Basis Tracking

Understanding how stock basis limitations impact your ability to claim losses is crucial. In an S corporation, you can only deduct losses to the extent of your basis in the stock. If your basis is low, you may not fully benefit from the losses, which can be frustrating.

Accurately tracking both AAA and basis is essential for effective tax planning. Failing to do so can lead to unexpected tax liabilities. When you know your AAA and basis, you can make informed decisions about distributions and losses.

If your AAA is lower than your basis, it may indicate that you’re missing out on tax-free distributions. Staying on top of these accounts helps ensure you’re maximizing your tax benefits while remaining compliant with IRS regulations.

Case Studies and Examples

Example of AAA Adjustments

Let’s consider a hypothetical S corporation, XYZ Corp. At the beginning of the year, its AAA stood at $10,000. During the year, XYZ Corp generated income of $15,000 and incurred losses of $5,000.

After accounting for these adjustments, the AAA would be recalculated like this:

- Starting AAA: $10,000

- Plus income: $15,000

- Minus losses: $5,000

Now, the new AAA balance is $20,000. If XYZ Corp then distributes $12,000 to its shareholders, they can receive this amount tax-free because it falls within the AAA limits. This example shows how adjustments to AAA can impact distributions and the overall tax situation for shareholders.

For those interested in understanding more about practical tax implications, consider reading “The Tax Book: A Comprehensive Guide for S Corporations”. It’s like having a tax advisor, minus the awkward small talk!

Example of Basis Adjustments

Consider another scenario with ABC Inc., where a shareholder has an initial basis of $50,000. During the year, ABC Inc. has a net income of $20,000 and distributions totaling $30,000.

Here’s how the basis would adjust:

- Starting basis: $50,000

- Plus income: $20,000

- Minus distributions: $30,000

After these calculations, the shareholder’s basis is now $40,000. If they had received a distribution that exceeded their AAA but remained below their basis, this would still be tax-free. However, if the distribution surpassed the basis, the excess would be treated as a capital gain. This illustrates how understanding basis adjustments can lead to better tax outcomes for shareholders.

Conclusion

Understanding why the Accumulated Adjustments Account (AAA) may be lower than basis is crucial for S corporation shareholders. Key takeaways include recognizing that AAA tracks undistributed income already taxed, while basis reflects total investment. Discrepancies can lead to taxable distributions, affecting overall tax positions. It’s essential to grasp these concepts for effective tax planning.

For tailored advice, consider consulting a tax professional who can provide insights specific to your situation. They can help clarify these complexities and ensure compliance with IRS regulations, maximizing your tax benefits. And if you’re looking for a great way to unwind after a long day of tax planning, why not enjoy some entertainment? The “The Office: The Complete Series” is a fantastic binge-watch!

FAQs

Please let us know what you think about our content by leaving a comment down below!

Thank you for reading till here 🙂

All images from Pexels